The Greatest Guide To COVID-19 Vaccine Distribution Update - Davis County

The Definitive Guide for Utah Health Insurance Plans: All You Need to Know - GoHealth

Living in Utah indicates you get to numerous medical insurance options. The alternatives you can select from will include something for everyone with various types of health coverage, cost points, and providers. If you pick to go without medical insurance in Alabama, you might wind up paying out-of-pocket. This can get really costly, even after simply one trip to the emergency situation room or medical professional.

It doesn't matter if you're searching for health protection in Utah for just you or for an entire family, there's a plan to fit your budget and requirements.

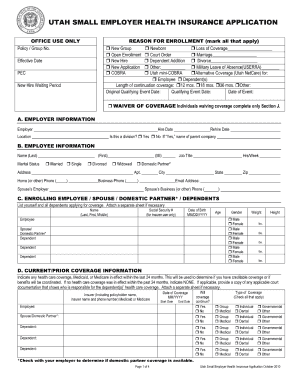

The function of this guide is to provide a general introduction of Utah small company health insurance coverage. The guide reviews little organization medical insurance options for Utah small services. Building a successful service is effort. Discovering cost effective small company medical insurance does not have to be. Another Point of View face unique difficulties when it concerns finding and getting medical insurance protection.

Getting My Compare Affordable Utah Health Insurance Quotes To Work

When evaluating your little organization medical insurance alternatives in Utah, you should right away compare the costs and advantages of the following three alternatives: Offering Standard Small Company Health Insurance Coverage Coverage, Offering a Defined Contribution Health Insurance that Reimburses Workers for Individual Medical Insurance Protection, and Offering Nothing There are two main classifications of health insurance for small companies to select from: Individual health insurance coverage, Group medical insurance.

Anybody can make an application for specific health insurance coverage. Small company owners who can't offer group coverage due minimum contribution (or minimum participation) requirements normally buy private and household plans for themselves and their households. In 2014, insurer will no longer be able to decline individuals for private medical insurance based on a pre-existing medical condition.

Sometimes, self-employed individuals who acquire their own health insurance may be able to subtract the expense of their regular monthly premiums. When small companies choose the individual health insurance coverage route, they often develop a "Pure" Specified Contribution Health Insurance to repay staff members tax-free for specific premiums Group health insurance coverage strategies are a kind of employer-sponsored health protection.

UNDER MAINTENANCE